An ABN is a formal notice given to Medicare beneficiaries to inform them about a particular service (before taking it) that may not be reimbursed by Medicare. If Medicare denies coverage for a particular treatment, the patient is responsible for its payment. The reason is that treatment does not fall under the Medicare coverage guidelines or that the services provided were not medically necessary.

The ABN form enables the patients to think about the services they are going to get and whether they are necessary for them or not. It allows patients to consider the financial impact on them, and they can make an informed decision.

Importance of ABNs:

ABNs clarify to patients and providers before getting the medical service cost that patients will pay for the particular procedure that Medicare does not cover, such as custodial care. ABN is essential for providers to avoid financial loss if Medicare denies coverage of non-covered services.

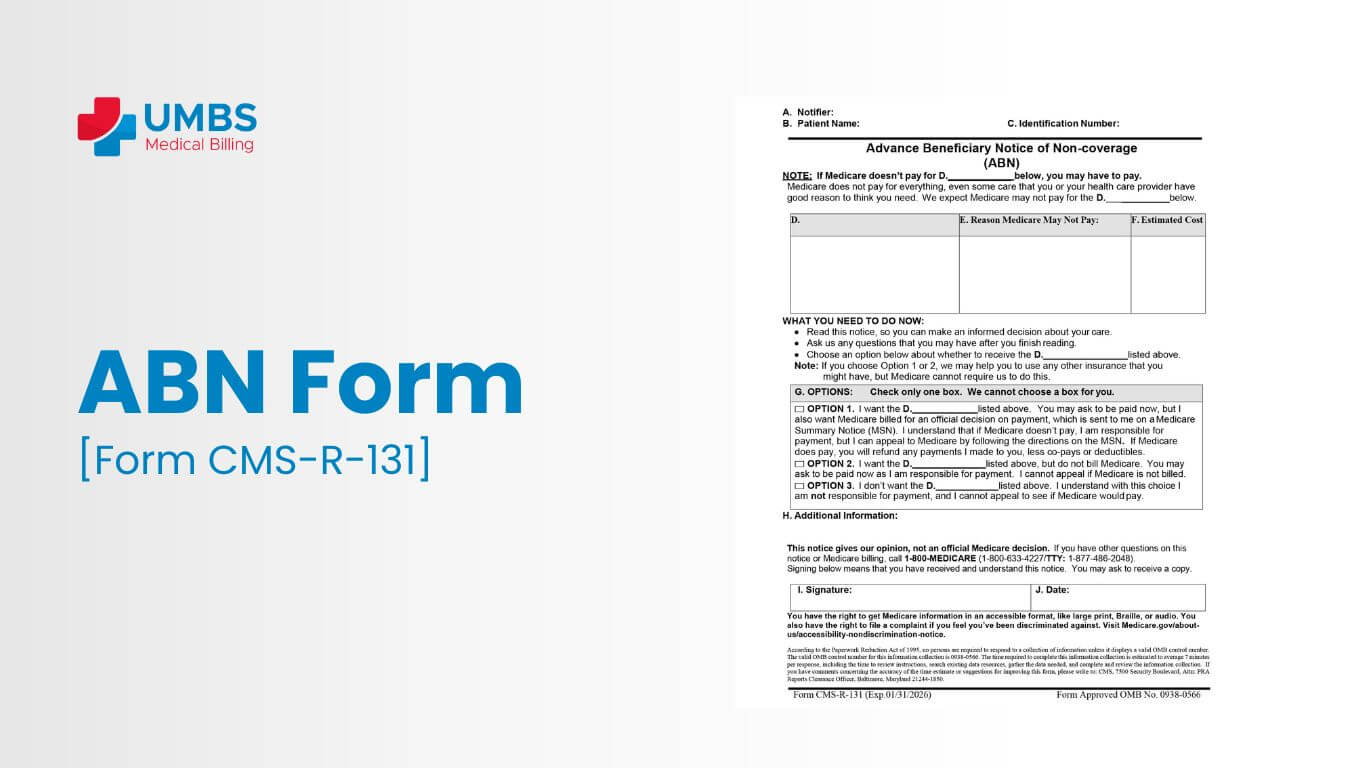

Healthcare providers use Medicare Advance Beneficiary Notice Form CMS-R-131 to inform beneficiaries of potential out-of-pocket costs due to medical necessity or frequency limitations, ensuring transparency and compliance.

ABNs Notice includes the following:

- Physicians

- Outpatient hospitals

- Independent laboratories

- Part B paid practitioners and suppliers

- Religious non-medical healthcare institutions

- Home health care agencies (HHAs) provide services under Part A or Part B.

- These providers must comply with Medicare regulations to ensure timely reimbursement.

Patient acknowledges full payment responsibility if Medicare denies reimbursement. No ABN, no reimbursement for excluded services; provider/supplier liable for declined payments.

Types of ABNs

a) SNFABN

A skilled nursing facility (SNF) issues a Skilled Nursing Facility Advance Beneficiary Notice (SNFABN), Form CMS-10055, when they determine that Medicare (Part A) may not cover or continue to cover care or stays due to medical necessity or custodial care reasons. The SNFABN informs the patient that Medicare is likely to deny coverage, empowering them to make informed decisions about their care and financial responsibilities.

b) HINN

Hospitals issue a Hospital Issued Notice of Noncoverage (HINN) when they determine that Medicare (Part A) won’t cover all or part of inpatient hospital care. By issuing this notice, hospitals inform patients about the coverage denial and explain the reasons behind it.

Compulsory ABNs:

In some scenarios, Medicare requires practitioners to provide ABNs before providing services. They are given below:

Crossing treatment annual limits:

Medicare sets annual limits for certain procedures. After attaining that session limit, any further sessions in that calendar year may not be covered. An ABN is issued to the patient before getting treatment to inform the patient about potential out-of-pocket costs.

Unnecessary Services:

Some services, like gym memberships as physical therapy do not fall under the category of “medically necessary,” and an ABN must be issued before proceeding to save both patient and practitioner from surprise billing.

Services with Limited or No Coverage:

Some services have no coverage, like manual therapy or particular modalities. These services are not included in Medicare. An ABN is essential to make the financial responsibility of the patient transparent to him/her.

Optional ABNs:

When services are covered by Medicare, practitioners still have the option to issue an ABN for transparency and information. This may be advantageous in the following ways:

- High Expense: If a service has high eligible expense, issuing an ABN helps in making an informed decision about the added costs of high copays.

- New Treatments: For new treatments, there may be potential non-coverage services.

- ABN on demand: Some patients want to know whether the service they are going to take comes under coverage or not, just want to know for peace of mind.

The procedure for reporting ABNs:

The billing office reports about the ABN using the following modifiers on the claim to clarify patient financial liability:

- GA is used for mandatory ABN

- GX is used for voluntary ABN

- GY is used when the service does not fulfill the Medicare guidelines

- GZ is used when the service is expected to be denied to provide an ABN

ABNs carry huge significance in clarifying the financial liabilities of the patient and ensuring transparency. It also helps in informed decision-making. It helps providers, patients, and medical billing service providers navigate the complexities of healthcare services and coverage.

Essential Components of the ABN Medicare Form:

As clarity is the key, it is important to know that the Medicare form should be easy to understand and provide all the required information, outlining the particular service.

Below are the essential components of an ABN Medicare form:

- Patient Basic Information: ABN form includes Name, address, and Medicare beneficiary number

- Service Explained: A detailed picture of the service to be provided.

- Reason for non-coverage: Mention the reason for non-coverage according to the Medicare guidelines.

- Payment Due: Mention the payment due to the patient if Medicare denies coverage.

- Patient signature with date: This ensures that the patient knows about the payment liability.

Use transparent communication to convey the message in the form of the ABN form. Positively answer the questions and concerns. ABN is a key to financial transparency and liability, contributing to a more collaborative healthcare experience. UMBS Medical Billing provider proactively educates beneficiaries about when an ABN is required or voluntary, empowering them to make informed decisions about their care and financial responsibilities.